Solar Tax Credit and Your Boat - Updated!

The US Federal Government continues to offer a solar energy tax credit, applicable to your primary and second homes, i.e. your boat or RV! As long as there is a head and galley onboard and it is docked in the United States, your vessel or vehicle qualifies.

This federal tax credit, in place since 2005 (known as the Investment Tax Credit, ITC) has been extended yet again to its current expiration through 2034 for non-commercial installations. Best grab it while you still can!

If you made no solar purchases this past year, worry not, there is still time to reap the benefits, both for your self with energy savings and your wallet for lessening the cost of that solar installation.

In the last few years, we've heard success stories from boat owners getting this tax credit when they file their yearly federal tax return. This credit can be retroactive – as long as the solar system was placed into service after January 1, 2006. However, the best benefit, 30%, comes when you apply for the credit for tax years 2022-2032.

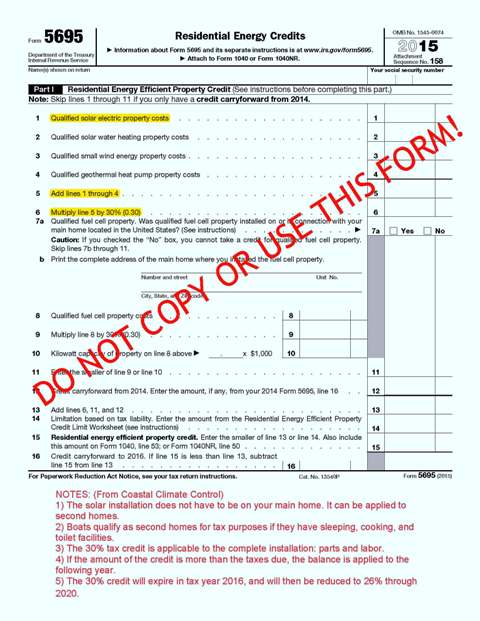

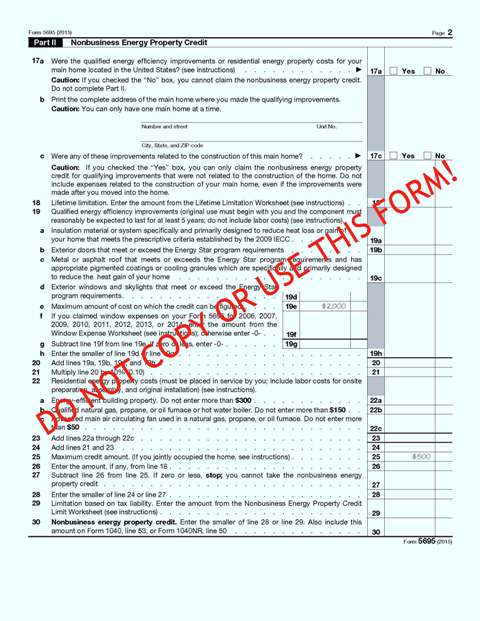

Check out this link to Energy Sage's website that gives a simplified description of the energy tax credit: https://www.energysage.com/solar/cost-benefit/solar-investment-tax-credit/. Want to see how simple the actual IRS form is to fill out: http://www.irs.gov/pub/irs-pdf/f5695.pdf. Your state government could also have a solar tax credit that may include sales taxes paid. It is be worth investigating.

Life has become so much easier for so many people since they took advantage of this tax credit. If you want solar power on your boat or camping car, it may have just become more affordable. Seize the Day!

Contact us at www.CoastalClimateControl.com about your marine solar system.

By accepting you will be accessing a service provided by a third-party external to https://coastalclimatecontrol.com/